Disclaimer

This tutorial on How To File KRA Returns for Students is an independent step-by-step guide by Tutorials Kenya. We are not affiliated with or endorsed by Kenya Revenue Authority (KRA) or any government agency in Kenya. This step-by-step tutorial is for informational and educational purposes only.

Filing on time ensures compliance with tax laws and helps avoid penalties, while also building a proper tax record for future needs like loans or scholarships.

READ ALSO: How To Download KRA PIN Certificate

To file KRA returns, students need a valid KRA PIN and an iTax account. Once registered on the iTax portal, they can follow a simple step-by-step process to submit their returns accurately and on time.

Submit Service Request

Waiting Duration: 5 minutes

You will receive your:

- KRA PIN Number

- KRA PIN Certificate

Via: Email Address and WhatsApp

How To File KRA Returns for Students

To file KRA Returns for Students, follow the outlined steps below.

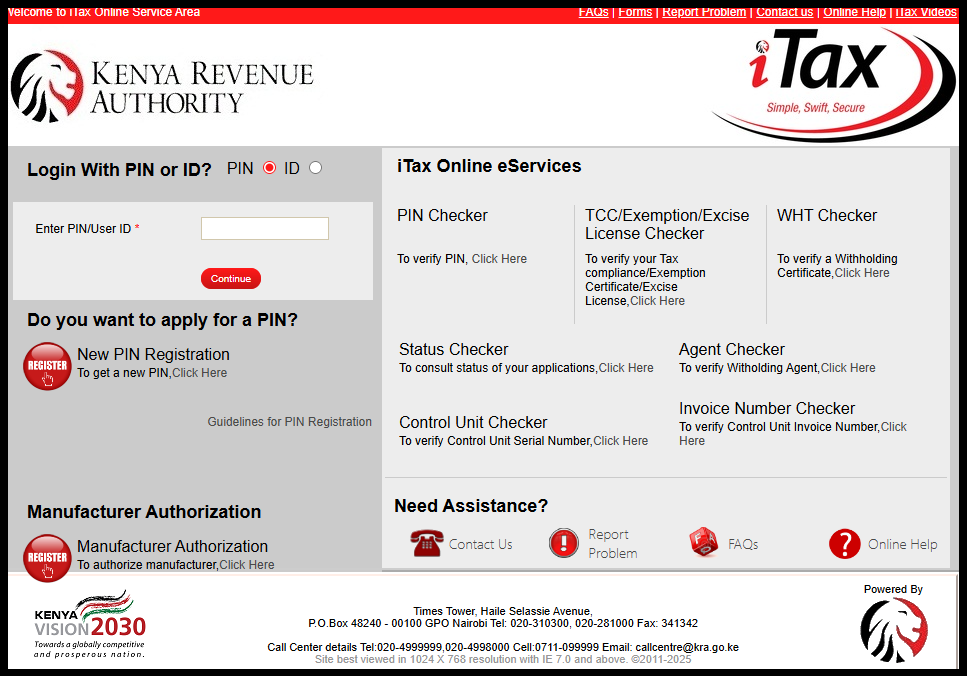

Step 1: Visit iTax (KRA Portal)

To file KRA Returns for Students, start by visiting iTax (KRA Portal) using this link: https://itax.kra.go.ke/KRA-Portal/

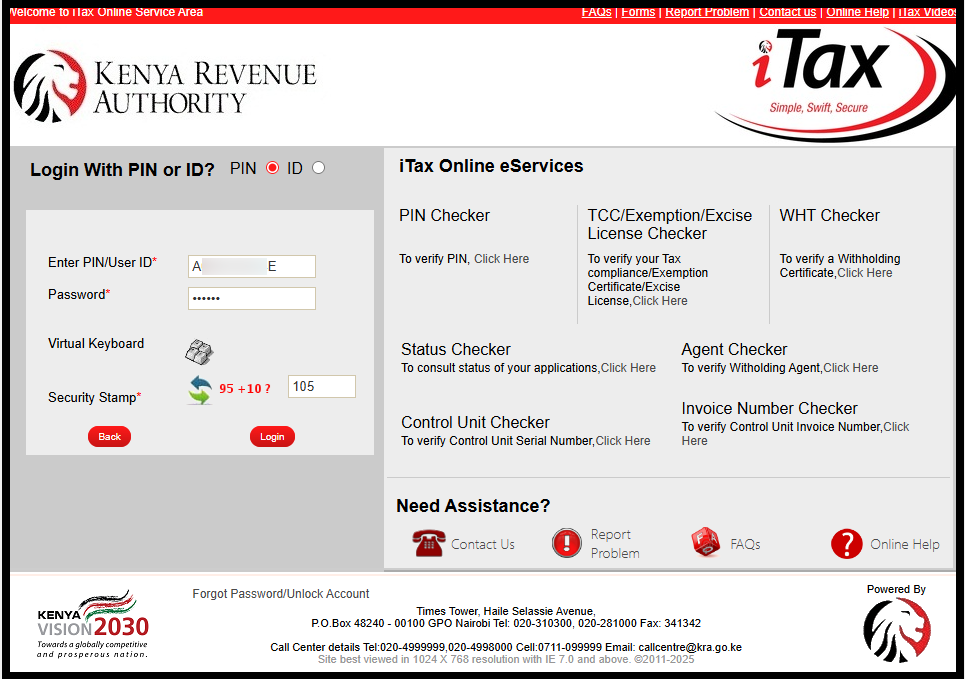

Step 2: Log in to iTax (KRA Portal)

Next, log in to iTax (KRA Portal) using either your KRA PIN Number or National ID Number, along with your KRA Password (iTax Password).

After entering your credentials, complete the arithmetic security question and click the “Login” button to access your KRA Portal account.

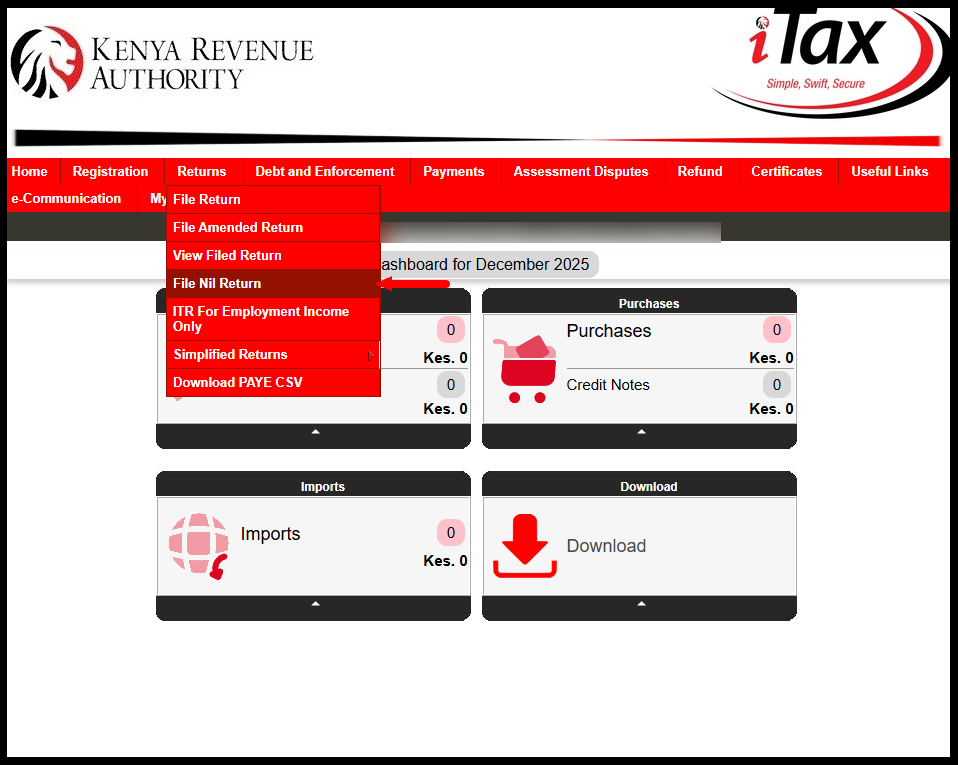

Step 3: Click on Returns then File KRA Nil Returns

After logging in to iTax (KRA Portal), go to the “Returns” menu and select “File KRA Nil Returns” from the dropdown list.

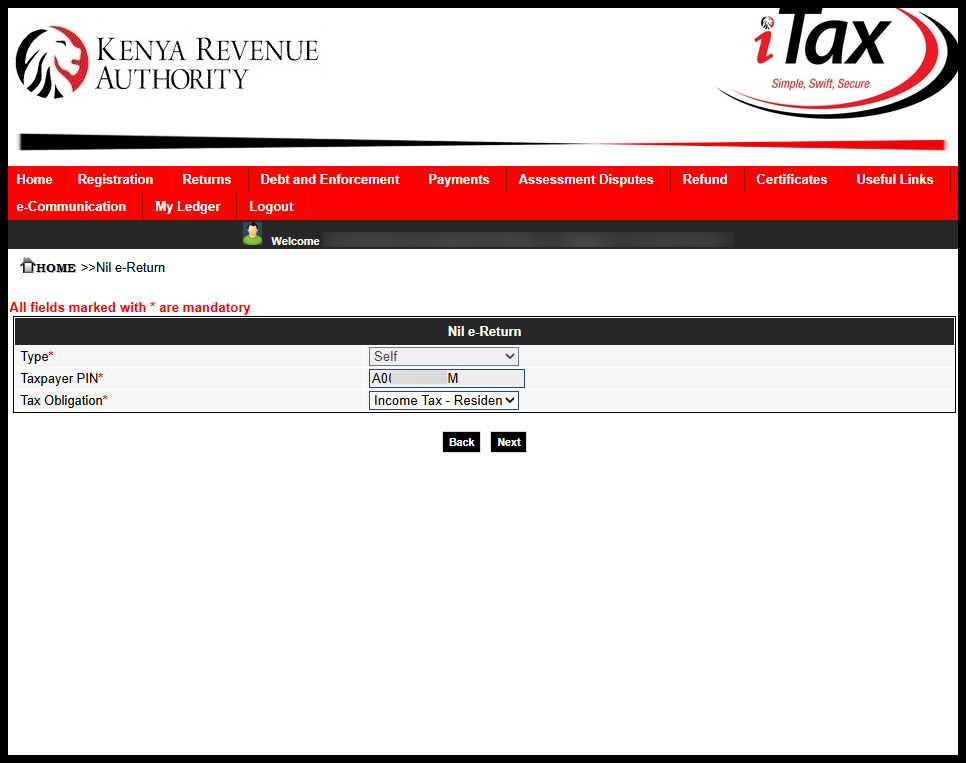

Step 4: Select KRA Tax Obligation

In this step, select the KRA Tax Obligation for which you want to file the Nil Returns. For students, choose “Income Tax – Resident Individual,” then click the “Next” button to proceed.

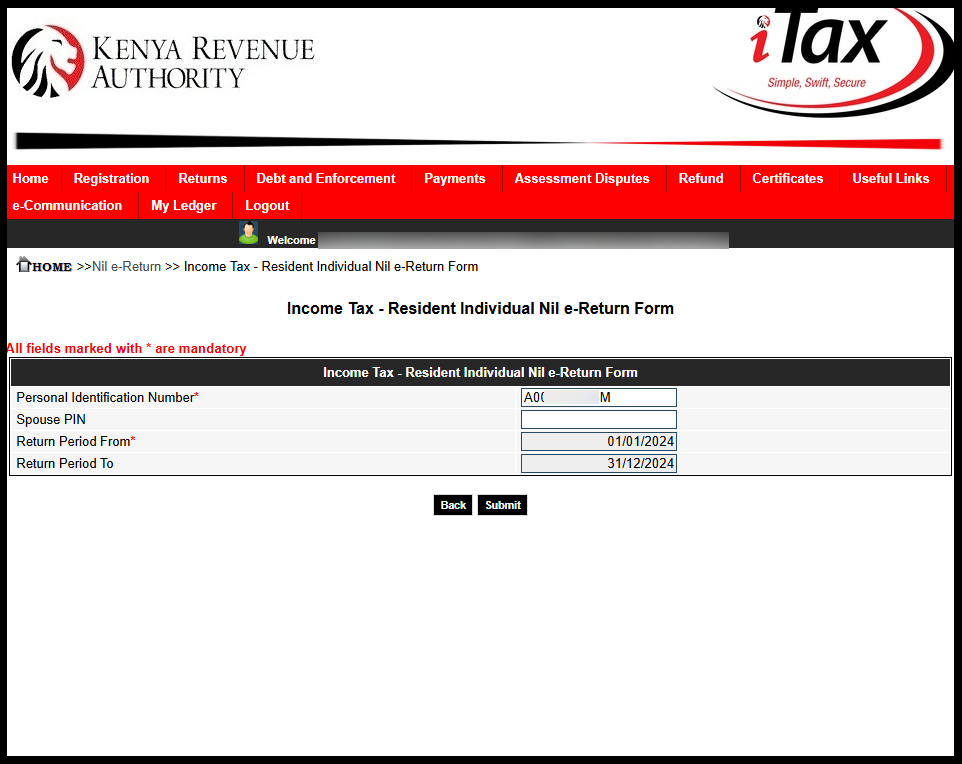

Step 5: Fill In The Income Tax – Resident Individual Nil e-Return Form

Next, fill in the Income Tax Resident Individual Nil e-Return form. If your KRA returns are up to date, entering the “Return Period From” will automatically set the “Return Period To.” For example, enter 01/01/2025 as the start date, which will set 31/12/2025 as the end date, then click “Submit.”

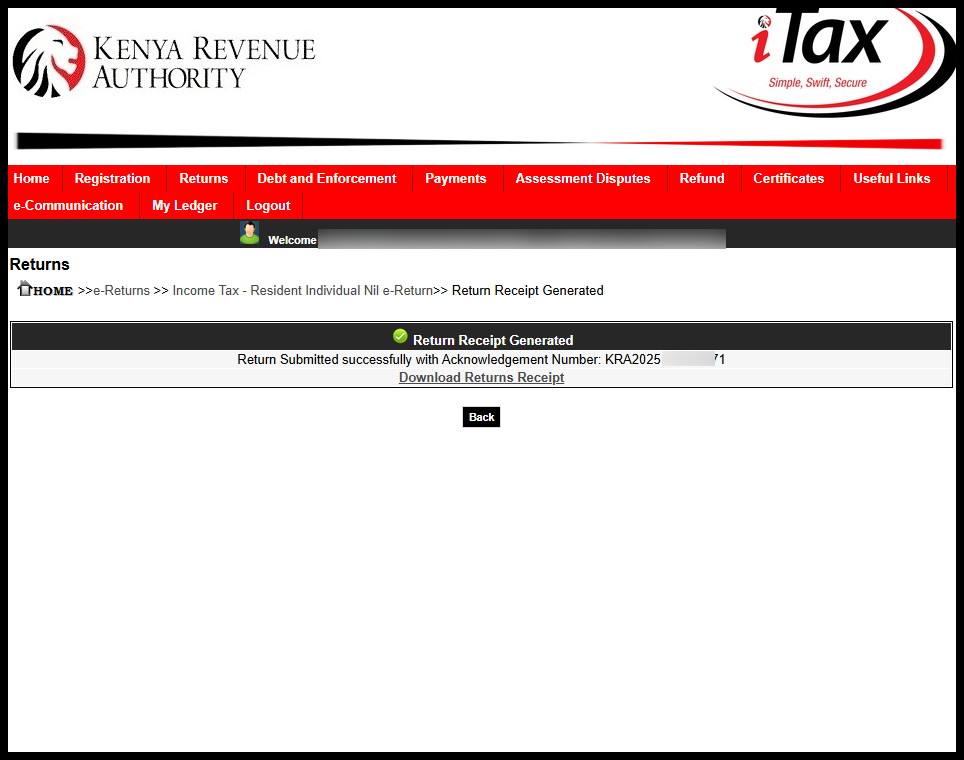

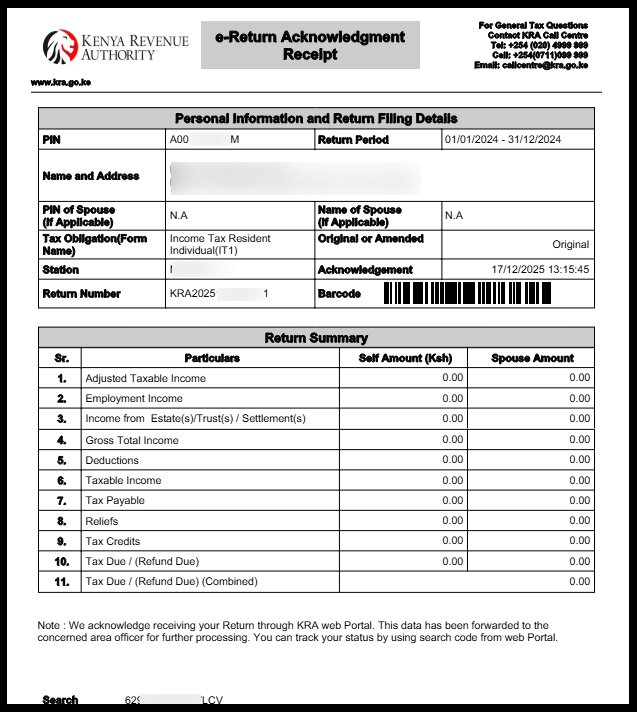

Step 6: Download KRA Returns Acknowledgement Receipt (e-Return Acknowledgement Receipt)

The final step in filing KRA Returns for students on iTax is to download the KRA Nil Returns Acknowledgement Receipt, also called the KRA Returns Receipt. Simply click the “Download KRA Returns Receipt” link to save or print a copy for your records.

Submit Service Request

Waiting Duration: 5 minutes

You will receive your:

- KRA PIN Number

- KRA PIN Certificate

Via: Email Address and WhatsApp

Downloading the receipt completes the filing process. Remember, to file KRA Nil Returns, you need your KRA PIN and iTax password to log in and submit the returns quickly and easily.

READ ALSO: How To File KRA Returns for Unemployed

The above steps sums up the whole process of How to File KRA Returns for Students in Kenya. If you want to file KRA Returns for Students, just follow the above simple steps.

Tutorials Kenya publishes clear step-by-step tutorials designed to help Kenyans understand online processes. Our step-by-step tutorials are written in very simple language to make online processes easier for all Kenyans.